Educational

How Independent Insurance Agents Can Finally Become Powerful Referral Partners (Not Just an Afterthought)

A Recap of The Power Producers Podcast with Andy Mathisen, Homebot Insurance Sales Manager

Let's be honest: as an independent insurance agent, you're usually the last call in a real estate transaction. The realtor gets the listing, the lender closes the loan, and somewhere in the final stretch before closing, someone remembers they need homeowners insurance. You get tagged in at the end, rush to quote, and hope you can deliver before the closing table.

It's not exactly a position of leverage.

And when it comes to staying in front of your existing book of business? Most independent insurance agents are stuck in a cycle of chasing X-dates, sending renewal reminders, and maybe dropping off donuts once a week hoping to stay top of mind with referral partners.

Andy Mathisen, Insurance Sales Manager at Homebot, recently joined David Carothers on The Power Producers Podcast to talk about how independent insurance agents can flip this script entirely, becoming the hub of the real estate transaction instead of the afterthought.

Watch the full episode here 👇

Short on time? Read on for the cliff notes.

The Problems Independent Insurance Agents Face With Marketing and Referrals

Andy and David didn't hold back on the challenges independent insurance agents are dealing with right now. Whether you're a solo agent building your book, a multi-producer agency scaling your team, or a P&C specialist looking to strengthen referral relationships, these problems likely sound familiar. From bottom-of-the-funnel positioning to outdated referral tactics, here's what's making growth so difficult.

1. You're at the Bottom of the Food Chain During Homeowner Transactions

The real estate transaction has a clear hierarchy, and independent insurance agents sit at the bottom of it. The flow moves from realtor to lender to insurance agent, which means by the time a prospect needs you, the relationship-building window has already closed.

Think about what this looks like in practice:

- A first-time homebuyer starts working with a realtor months before closing

- They build rapport, exchange dozens of emails, tour properties together, and develop genuine trust

- The realtor refers them to a lender, and that relationship develops over weeks of document gathering, pre-approval conversations, and rate discussions

- By the time insurance enters the picture, there's maybe a week before closing

- The buyer just needs someone to check a box

You're not building a relationship at that point. You're completing a transaction.

When renewal time comes around, that client has no particular loyalty to you because you were never given the chance to demonstrate ongoing value.

This positioning problem forces independent insurance agents into a reactive stance. You're always waiting for the handoff instead of driving conversations. You're hoping referral partners remember to send business your way instead of having a system that makes referrals automatic.

2. Staying in Touch With Your Book Is Genuinely Hard

Once you've written a policy, what reason does a homeowner have to hear from you? Unlike their mortgage lender who sends monthly statements or their realtor who might check in around market updates, independent insurance agents struggle to find natural touchpoints that aren't tied to renewals or upsells.

Most agents default to one of a few approaches:

- X-date campaigns: You reach out when it's time to re-quote or when you're trying to win business from a competitor. This is inherently transactional and trains clients to only hear from you when you want something.

- Renewal reminders: Necessary, but not relationship-building. Nobody feels warmly toward their insurance agent because they got a reminder that a bill is due.

- Cross-sell attempts: Reaching out to round accounts or add umbrella coverage is good business, but again, the client knows you're contacting them because you want to sell something.

- Holiday cards and birthday emails: Nice gestures, but they don't provide any real value. They're easily ignored and don't differentiate you from any other business sending the same generic messages.

The core issue is that independent insurance agents don't naturally have valuable content to share. A lender can talk about rate changes, equity positions, and refinance opportunities. A realtor can share market updates, neighborhood comps, and investment insights. What does an insurance agent have to offer between renewals? For most, the answer is not much.

3. Traditional Referral Relationship Tactics Aren't Working Anymore

The old playbook for building referral relationships has run its course. Independent insurance agents have been using the same tactics for decades, and loan officers and realtors have seen it all.

- The donut drop: Stopping by a lender's office with breakfast pastries might have worked when there were fewer agents competing for attention. Now, every independent insurance agent in town is doing the same thing, and the gesture has lost any differentiating value. It's noise, not signal.

- The referral fee: Offering $50 or $100 per closed referral feels transactional and, frankly, a little desperate. Loan officers who close deals worth thousands in commission don't need your referral fee. They need partners who make their jobs easier and help them retain clients over the long term.

- The "let's grab coffee" ask: Cold outreach to loan officers and realtors asking to meet and "explore synergies" is easy to ignore. These professionals are busy, and a vague request for their time with no clear value proposition goes straight to the bottom of their priority list.

- The hope-and-pray approach: Many independent insurance agents simply wait for referral partners to remember them. They do good work, assume word will spread, and hope that realtors and lenders will send business their way organically. Sometimes this works. Often it doesn't.

The fundamental problem is that independent insurance agents are asking for referrals without having a systematic way to give value in return. You're approaching these relationships from a position of need rather than a position of strength.

As Andy put it during the podcast:

"If you're just dropping off donuts once a week, I did it for years and years. It doesn't work anymore unless you have good relationships with these folks. Loan officers don't need your 50 bucks. That's cheesy. Let's just give them a deal." -Andy Mathisen, Insurance Sales Manager at Homebot

4. Paid Leads Deliver Volume, Not Quality

When organic growth and referrals stall, many independent insurance agents turn to paid lead generation. The math seems simple: spend money on Meta ads or lead aggregators, get a certain number of prospects, close a percentage of them, and scale from there.

The reality is messier. The problems with paid leads:

- They require massive filtering to find quality prospects

- You're competing with other agents who bought the same leads

- Response time becomes critical because whoever calls first often wins, regardless of fit

- The clients you do close often have no loyalty because they were shopping purely on price

Compare this to inbound leads from valuable content:

- Someone finds your agency through a helpful blog post

- They read several articles and explore your website

- They fill out a quote request after investing time learning about your approach

- They're not just looking for the cheapest option

- These leads close at dramatically higher rates because the trust-building has already begun

The challenge is that creating valuable content consistently is time-consuming, and most independent insurance agents don't have the bandwidth or expertise to do it well.

5. Most Tools Automate Outreach, Not Value

There's no shortage of marketing automation tools promising to help independent insurance agents stay in touch with their book. Email platforms, CRM sequences, text message campaigns, social media schedulers. The options are endless.

But there's a crucial distinction most of these tools miss: automating outreach is not the same as automating value.

The harsh truth about most automation:

- Sending more emails doesn't help if those emails don't contain anything your clients actually want to read

- Increasing touchpoints backfires if every touchpoint feels like a sales pitch

- The goal isn't to contact your book more often

- The goal is to provide genuine value that keeps you top of mind and positions you as a trusted resource

Most automation tools available to independent insurance agents solve the wrong problem. They make it easier to reach out but don't give you anything meaningful to say.

The Solution: Homebot's Client Engagement Platform for Independent Insurance Agents

Do these problems sound familiar?

If you're nodding along to any of these challenges, you're not alone. These are systemic problems baked into how the real estate transaction works and how the insurance industry has traditionally approached marketing.

But some independent insurance agents are flipping this dynamic entirely by utilizing Homebot. Homebot has expanded its platform to serve independent insurance agents, and the value proposition addresses these challenges directly. Here’s how:

1. A Monthly Touchpoint That's Actually Valuable

Homebot sends your clients a monthly "Home Digest" with personalized information about their property. This isn't a sales pitch. It's genuinely useful content homeowners want to engage with.

What's included in the monthly Home Digest:

- Current estimated home value

- Loan balance and what they've paid toward principal and interest

- Available equity and purchasing power

- Refinance options, HELOC options, and cash-out options

- New purchase possibilities based on their financial position

The engagement numbers tell the story. Andy shared that Homebot sees 76% open rates and 36% click-through rates across their platform. Compare that to the industry average for email marketing, which hovers around 20% open rates and 2-3% click-through rates. The difference is that Homebot delivers content people actually want to see.

"The hook on the email is super easy. It's just what is your home value? Each and every month, Homebot is providing homeowners with their home value. That's content that one, I'm interested in. Two, I will engage with. And three, I know it's coming every month, so I get used to that." -Andy Mathisen, Insurance Sales Manager at Homebot

Every month, your clients get something valuable from you without you lifting a finger. You become associated with useful information rather than sales pitches.

2. Become the Hub of the Transaction, Not the Spoke

Here's where Homebot gets strategic for independent insurance agents looking to build referral relationships.

When a client lands on their Home Digest, they see their "team of professionals" displayed prominently. Homebot pulls in the public record data to identify who helped with the original transaction and keeps everyone connected through Homebot's Network of connected referral partners.

The team displayed includes:

- Their insurance agent (you)

- The lender who closed their loan

- The realtor who helped them purchase

Here's how the referral flow works in practice:

- Your client receives their monthly Home Digest from you

- They see they have $80,000 in equity and start thinking about a kitchen renovation

- They click through to explore HELOC options

- They reach out to the lender directly through the platform to discuss

- You get notified that you just generated a lead for that lender

- The lender now has tangible proof that your relationship delivers value

"In essence, the insurance agency is teeing up deals for lenders and realtors that they may or may not work with. It's very challenging for insurance agents to send deals back to loan officers and realtors. You're hand selecting folks randomly. Maybe you have a friend or family member that's ready for something. But in general, I find it hard for anyone to take advantage of that book of business. The system is literally enabling your database to do it themselves, and then you look good because you're hooking up realtors and lenders." -Andy Mathisen, Insurance Sales Manager at Homebot

Instead of awkwardly asking loan officers and realtors for referrals, you're actively sending them business through your engaged client base. That changes the entire dynamic of those relationships.

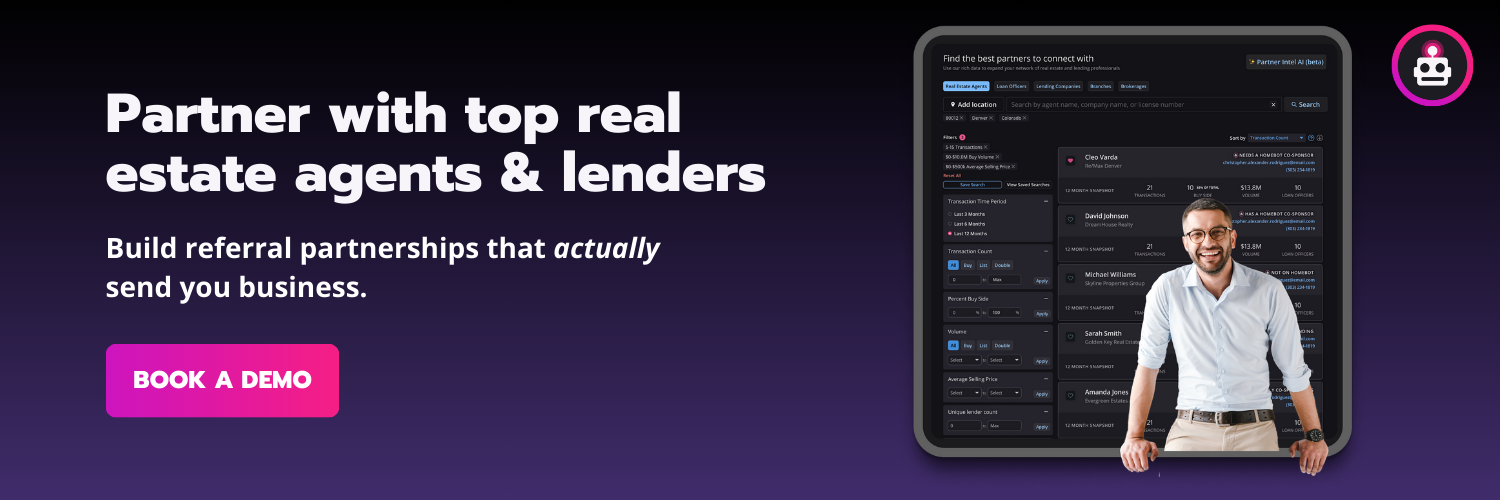

3. Partner Intel Helps You Target the Right Relationships

Building referral relationships is time-consuming, and not every loan officer or realtor is worth pursuing. Homebot's Partner Intel feature helps independent insurance agents focus their efforts where they'll have the most impact.

What Partner Intel shows you:

- Which loan officers share mutual clients with your book

- Which realtors have worked with your existing clients

- Production data on potential referral partners in your market

This makes outreach infinitely easier. Instead of cold calling loan officers with a generic pitch, you can reach out with something specific and valuable.

"If I load up a thousand clients, I will have the visibility of which loan officers and which realtors I have mutual clients with. So you're essentially saying, 'Hey loan officer, I might not know you, but we have mutual clients and I got your back. I will give you another bite at the apple, another swing at bat when our mutual client needs something real estate or lending related.'" -Andy Mathisen, Insurance Sales Manager at Homebot

That's a much stronger opening than asking if they'd like to grab coffee sometime.

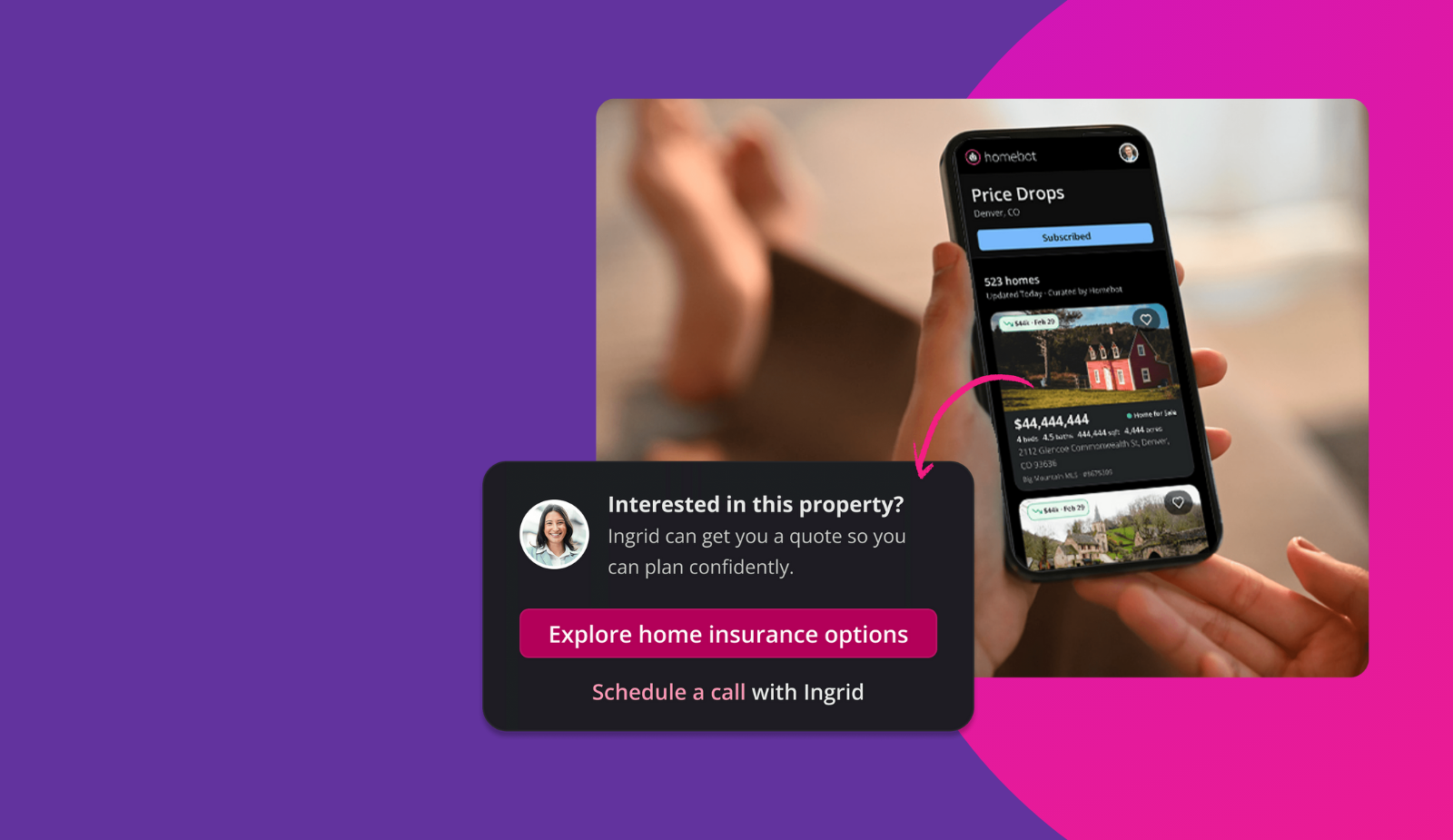

4. Get Ahead of Transactions With Private Home Search

Homebot includes a private home search tool that functions like Zillow but with one critical difference: it's only visible to you and your connected partners.

Why this matters for independent insurance agents:

- When a client starts browsing homes, you know about it before anyone else

- They're not getting bombarded by dozens of agents from a public search platform

- You can reach out proactively when a client is considering a move

- You stay at the front of the conversation instead of waiting to be tagged in at the end

"Zillow is a public search tool. Anyone can go to zillow.com and look up a home that's active or closed. We're private. You can only use it if you get invited. In this case, the insurance agency is providing it. It's keeping them in front of the same lender, realtor, and insurance agent. We're not gonna expose you to someone new." -Andy Mathisen, Insurance Sales Manager at Homebot

This flips the traditional dynamic on its head. Instead of being the last professional involved in a real estate transaction, independent insurance agents using Homebot can be among the first to know a transaction is coming.

5. Proactive Insurance Renewal and Home Maintenance Alerts

Homebot also includes features specifically designed for independent insurance agents to stay ahead of policy renewals and demonstrate ongoing value.

Insurance-specific features include:

- 60-day renewal alerts: The system estimates when a client's home insurance renews based on their purchase date and notifies them to review coverage with their insurance team. This gives you a natural touchpoint that's framed as helpful rather than salesy.

- Home maintenance schedules: Seasonal content goes out reminding homeowners about maintaining insurability. Topics include roof inspections, plumbing updates, electrical system checks, and HVAC maintenance. This positions you as an advisor, not just a policy vendor.

- Home buyer's insurability checklist: Educational content that helps homeowners understand what keeps their property insurable and their premiums manageable.

These touchpoints reinforce your role as a trusted resource while giving clients actionable information they can use.

6. The 12-Year Opportunity Sitting in Your Database

Here's a data point from Homebot's platform that should change how independent insurance agents think about their book of business.

"We do find out through our metrics of millions of consumers receiving Homebot that those that stay in their home are gonna live there about 12 years before they list again. So your database, essentially every 12 years is gonna have a new home purchase." -Andy Mathisen, Insurance Sales Manager at Homebot

That's 12 years of monthly touchpoints where you're adding value and staying top of mind. Twelve years of generating referrals for your lending and real estate partners. Twelve years of reinforcing that you're the obvious choice when they do move and need new coverage.

Most independent insurance agents aren't thinking about their book this way. They're focused on the next X-date or the next renewal. Homebot helps you play the long game while your competitors fight over short-term transactions.

What This Means For Your Insurance Agency

David made an important point during the episode about how Homebot changes the conversation for independent insurance agents building referral relationships.

"If you're an agency that's using Homebot, that becomes a differentiator at the point of sale. That should be discussed upfront. If I'm gonna go in and I'm gonna talk to a real estate agent, I want to go in and I'm not gonna ask them for their referrals. I'm gonna tell 'em what I can do for them, and the referrals will come." -Andy Mathisen, Insurance Sales Manager at Homebot

Key benefits for independent insurance agents using Homebot:

- Automated value delivery: Monthly touchpoints that clients actually want to receive

- Referral leverage: Documented proof of the deals you're sending to partners

- Proactive positioning: Know when clients are searching or ready to transact before competitors do

- Relationship intelligence: Identify mutual clients with potential partners to warm up outreach

- Client retention: Stay top of mind between renewals with content that reinforces your value

Accessible Pricing for Independent Agencies

For agencies concerned about adding another tech expense, Homebot has kept pricing accessible for independent insurance agents. The platform operates on month-to-month agreements with no long-term commitment required.

"We have a month-to-month agreement, we have very inexpensive pricing, and we want people to know that this is gonna work." -Andy Mathisen, Insurance Sales Manager at Homebot

With 60+ agencies already on board since the October 1st launch, early adoption signals are strong.

Tips for Improving Your Marketing Beyond Homebot

Beyond Homebot, Andy and David covered several other topics independent insurance agents should pay attention to. Here are the highlights.

1. Your Website Needs to Convert, Not Just Exist

David shared his approach to content-driven growth and why so many independent insurance agents are leaving leads on the table with weak websites.

"People aren't ever gonna find my blog because of my website. They're gonna find my website because of my blog. The overwhelming majority of traffic that goes to the Florida Risk website is going because one of our blog posts ranks on the first page of Google for that industry or that topic." - David Carothers, Host of The Power Producers Podcast

The insight here is that content drives traffic, but your website needs to convert that traffic into leads. If someone finds your agency through a valuable blog post and then lands on a skeleton website with no clear call to action, you've wasted the opportunity.

Action items for independent insurance agents:

- Audit your website for clear calls to action on every page

- Make sure your contact forms are prominent and easy to complete

- Tell your story and build trust before asking for the quote

- Don't invest in traffic generation until your website can convert that traffic

2. Don't Let Technology Outpace Your Processes

David cautioned against adopting technology before your agency is ready to use it effectively.

"A lot of people will look at tech and they want to bring it in because they think that's what's gonna solve the problem. But they don't deal with the root cause of the problem, which is the fact they don't have a process to begin with." - David Carothers, Host of The Power Producers Podcast

Every trade show introduces independent insurance agents to new tools promising to solve their problems. The danger is implementing technology without having the underlying processes in place to make it work.

Before you add a new tool, ask yourself:

- What specific problem does this solve?

- Do we have a documented process for the workflow this tool supports?

- Who owns implementation and ongoing optimization?

- How will we measure whether it's actually working?

3. Protect Your Book by Protecting Your Standards

David shared his philosophy on qualifying prospects and why independent insurance agents should resist the temptation to write business outside their ideal client profile.

"I have a fundamental belief that every time I compromise from my ideal prospect profile, I dilute the value proposition to everybody who's already in my book because that's always that person that's outside of what you want that ends up being the biggest headache, causes the most problems, and takes you away from your ability to handle servicing for the rest of your book because it's out of balance." - David Carothers, Host of The Power Producers Podcast

The pressure to grow can push independent insurance agents to take on clients who aren't a good fit. But those clients often require disproportionate service time, generate more complaints, and distract from serving your best clients well.

4. Answer Your Phone

Andy shared a frustration that independent insurance agents should take to heart: too many agencies aren't answering their phones.

"The amount of people that actually pick up the phone is like five, maybe 10%. These agencies are just simply not picking up the phone. I don't care who's on the other line. Pick it up. Understand who's reaching out. You can move on with your day as simple as 10 seconds in, but at least pick up the damn phone." -Andy Mathisen, Insurance Sales Manager at Homebot

Whether it's spam fatigue, being too busy, or poor phone systems, independent insurance agents who don't answer calls are missing opportunities. If you can't answer every call yourself, implement a virtual receptionist or AI phone system to screen and route calls appropriately. But don't let calls go to voicemail by default.

Conclusion: Stop Asking for Referrals and Start Generating Them

Independent insurance agents are stuck at the bottom of the real estate food chain, struggling to stay in front of clients between renewals and relying on outdated referral tactics that don't deliver. The agents winning today are the ones who provide ongoing value automatically and send deals to their referral partners instead of asking for them.

Whether you're a solo agent building your book, running a multi-producer agency, or looking for better ways to stay top of mind with your P&C clients, the solution is the same: you need a system that delivers value without adding to your workload.

Homebot does exactly that.

- Monthly home value updates your clients actually want to see

- Referral tracking that proves your value to lending and real estate partners

- And a platform that scales with your business

Request a demo and see why 60+ independent insurance agencies have already come on board.

Want more insurance agent growth content?

- Watch the full episode from Power Producers Podcast here.

- Subscribe to The Power Producers Podcast for more insights on refining and redefining the insurance sales game.